The finance industry is witnessing a significant shift towards predictive analytics, with the market expected to reach $27.51 billion by 2034. A study from ResearchGate highlights the success story of GlobalTech, which saw a 25% reduction in forecasting errors and a 20% increase in profitability within the first year of adopting predictive analytics. This success story showcases the effectiveness of predictive analytics in finance.

Leading financial institutions like HSBC, Revolut, J.P. Morgan, and Danske Bank are leveraging predictive analytics to enhance their operations. With applications in risk management, fraud detection, banking analytics, and more, predictive analytics offers benefits such as proactive decision-making, increased accuracy, efficiency, better risk control, improved customer experiences, and revenue growth.

From real-time fraud detection to personalized banking experiences, predictive analytics has become a cornerstone of modern finance.

This article delves into the concept of predictive analytics in finance, exploring its meaning, applications, significance, and impact on the financial industry. It also addresses implementation challenges, solutions, and future trends, providing valuable insights for organizations considering Fintech IT solutions for their financial needs.

Key Takeaways

- Predictive analytics transforms finance from reactive to proactive decision-making, leveraging AI, machine learning, and real-time data to anticipate risks, customer behavior, and market trends.

- Various predictive models, including classification, clustering, time series, anomaly detection, and regression, power financial insights for forecasting, risk management, and optimization.

- Use cases of predictive analytics in finance span fraud prevention, credit scoring, personalized banking, investment analytics, and cash flow forecasting.

- Predictive analytics offers tangible benefits such as cost reduction, efficiency improvement, enhanced customer experiences, and revenue growth for financial institutions.

- Successful adoption of predictive analytics in finance requires transparency, security, compliance, and a focus on explainable AI, data governance, regulatory alignment, and cybersecurity.

- Future trends in predictive analytics for finance include AI-driven real-time analytics, blockchain integration, and decentralized finance solutions.

Understanding Predictive Analytics in Finance

Predictive analytics in finance involves utilizing AI, machine learning, historical & real-time data, and statistical methods to predict future financial outcomes such as market trends, customer behavior, and risks. This practice enables financial institutions to make informed decisions and anticipate future scenarios.

- It helps answer critical questions like what will happen next, which customers are at risk, how market conditions might change, and where potential fraud risks lie.

By leveraging predictive analytics, financial institutions can transition from reactive to proactive strategies, optimize investments, personalize services, prevent defaults, and improve overall efficiency by uncovering hidden patterns in complex datasets.

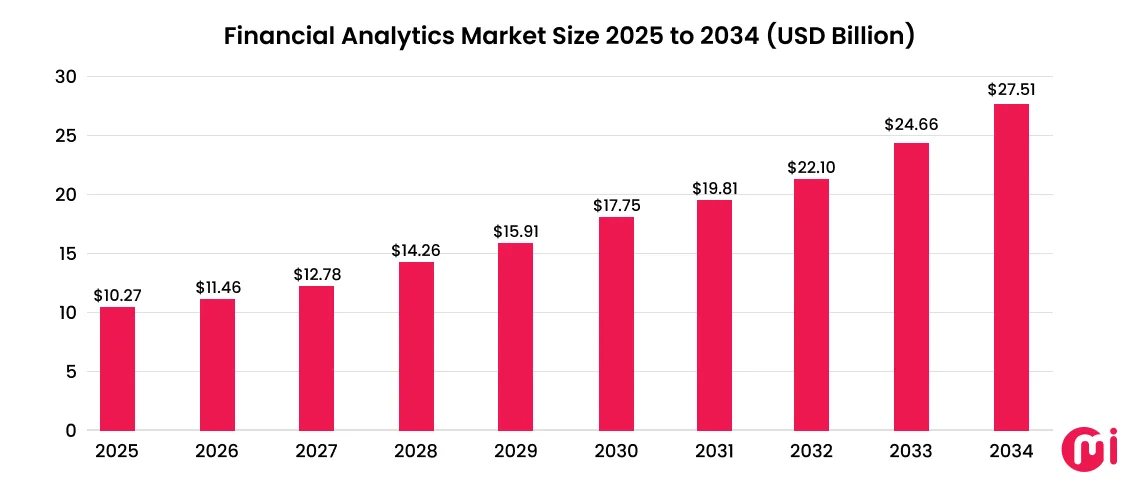

Financial Data Analytics Market Statistics

The global financial analytics market is projected to reach $27.51 billion by 2034, showcasing a substantial growth trajectory from $9.20 billion in 2024. This expansion is expected to continue at a CAGR of 11.57% from 2025 to 2034.

Research from Mordor Intelligence and Fortune Business Insights supports this growth trend, with predictions of the financial analytics market reaching $21.27 billion by 2030 and $22.64 billion by 2032, respectively.

- The forecasted CAGR for the financial analytics market is expected to be around 11.3% during the forecast period.

Key Predictive Analytics Models in Finance

Predictive analytics models play a vital role in finance, encompassing classification, clustering, time series, anomaly detection, and regression models. These models analyze historical data to provide insights that aid in decision-making processes related to risk management, fraud detection, and investment optimization.

Classification Models

Classification models categorize data points into predefined groups based on their features, aiding in credit approval decisions, fraud detection, and customer churn prediction.

Popular techniques include decision trees, logistic regression, and random forests.

Clustering Models

Clustering models group data based on similarities without predefined labels, facilitating customer segmentation, behavioral analysis, and portfolio grouping.

Time Series Models

Time series models analyze data over time to identify trends and patterns crucial for forecasting stock prices, revenue, interest rates, and volatility.

Anomaly Detection Models

Anomaly detection models flag unusual patterns in data, aiding in fraud detection, anti-money laundering, and cybersecurity efforts.

Regression Models

Regression models predict continuous outcomes based on independent variables, assisting in forecasting loan defaults, asset prices, and financial performance metrics.

Use Cases of Predictive Analytics in Finance

Predictive analytics applications in finance span various areas, including risk management, fraud detection, banking analytics, cash flow forecasting, and more. These use cases empower financial institutions to mitigate risks, enhance efficiency, and make informed decisions in a complex environment.

Risk Management

Predictive analytics aids in identifying, measuring, and managing credit, market, and liquidity risks, enabling institutions to strengthen capital planning, improve resilience, and reduce exposure to market disruptions.

Fraud Detection & Prevention

Real-time monitoring enables financial institutions to detect fraudulent activities swiftly and adapt to evolving fraud tactics, enhancing detection accuracy while minimizing false alerts.

Investment & Trading Analytics

Predictive insights help traders and asset managers forecast price movements, assess market trends, and optimize portfolios to navigate market volatility and enhance investment performance.

Banking & Lending Analytics

By analyzing customer behavior, financial institutions can improve credit evaluations, automate loan approvals, and predict defaults, resulting in faster processing, improved risk control, and balanced loan portfolios.

Personalized Banking & Customer Analytics

Generative AI-powered predictive analytics enable banks to personalize services, predict customer behavior, and offer tailored recommendations, leading to enhanced customer satisfaction and retention.

Cash Flow & Financial Forecasting

Accurate cash flow forecasting is crucial for financial stability, with predictive analytics providing insights into revenue trends, expense patterns, and funding requirements, supporting better budgeting and decision-making.

Regulatory & Compliance Analytics

Predictive analytics aids in identifying high-risk activities, ensuring compliance, and strengthening governance frameworks, reducing regulatory penalties and enhancing audit readiness.

Insurance & Risk Underwriting

Insurers leverage predictive analytics to enhance underwriting, pricing, and risk assessment, leading to competitive pricing, reduced losses, and improved profitability.

Benefits of Predictive Analytics in Finance

Predictive analytics in finance offers a range of benefits, including proactive decision-making, higher accuracy, operational efficiency, risk mitigation, enhanced customer experiences, and revenue growth.

Proactive and Predictive Decision-Making

Predictive analytics enables organizations to anticipate risks, market changes, and customer behavior, facilitating proactive decision-making and timely responses to opportunities and threats.

Higher Accuracy and Operational Efficiency

Automated predictive models enhance accuracy, streamline operations, and reduce human error, improving forecast accuracy and operational efficiency.

Reduced Financial Risk and Loss Exposure

Predictive analytics aids in identifying potential defaults, fraudulent activities, and market fluctuations early, enabling institutions to minimize losses and strengthen risk management strategies.

Enhanced Customer Experience and Personalization

By understanding customer needs and behavior, financial institutions can offer personalized services, faster approvals, and relevant recommendations, enhancing customer satisfaction and loyalty.

Data-Driven Strategic and Financial Planning

Predictive insights support strategic decision-making by analyzing trends, forecasting outcomes, and aligning financial goals with business strategies, enabling effective capital allocation and preparation for market conditions.

Lower Operational Costs

Efficiency gains through automation and streamlined processes reduce operational costs, optimize resource utilization, and minimize fraud-related losses, leading to significant cost savings for financial institutions.

Increased Revenue and Profitability

Improved targeting, pricing strategies, and investment decisions driven by predictive analytics directly contribute to revenue growth and profitability, enabling financial institutions to identify opportunities, optimize margins, and enhance financial performance.

Successful Examples of Predictive Analytics in Finance

Leading financial institutions like HSBC, Revolut, J.P. Morgan, and Danske Bank have successfully implemented predictive analytics to enhance their operations and deliver superior outcomes for both customers and institutions.

HSBC:

HSBC utilizes an AI-based predictive analytics tool to detect and prevent financial crimes, leading to a more efficient detection process and improved customer experience.

Revolut:

Revolut’s in-house machine learning system, “Sherlock,” has significantly reduced fraudulent transactions, resulting in substantial savings and enhanced fraud prevention capabilities.

J.P. Morgan:

J.P. Morgan’s cash-flow forecasting AI solution has automated multi-entity forecasting for corporate clients, reducing manual work, labor costs, and resolution times, enhancing financial operations efficiency.

Danske Bank:

Danske Bank transitioned to deep-learning models for fraud detection, resulting in a significant reduction in false positives and increased true-fraud detection rates, showcasing the power of predictive analytics in fighting financial crimes.

Challenges, Limitations, and Mitigation Strategies in Predictive Analytics for Finance

Despite its advantages, predictive analytics in finance presents challenges such as data quality issues, model bias, and compliance concerns that organizations must address to ensure accuracy, compliance, and trust.

Data Quality & Availability Issues

Inaccurate or incomplete data can impact model accuracy and reliability, necessitating strong data governance, data cleaning processes, and continuous monitoring of data quality.

Model Bias and Interpretability

Advanced models may lack transparency, necessitating the adoption of explainable AI techniques, bias testing, and human oversight to ensure fairness and accountability.

Regulatory & Compliance Concerns

Financial institutions must ensure that predictive models comply with regulations, requiring integration of compliance requirements, detailed documentation, and governance processes for validation and review.

Cybersecurity and Data Privacy Risks

Managing sensitive financial data increases exposure to cybersecurity threats, necessitating robust cybersecurity measures, encryption standards, and privacy regulations compliance.

Future Trends of Predictive Analytics in Finance

The future of predictive analytics in finance is marked by advancements in AI-driven real-time analytics, blockchain integration, and decentralized finance solutions, shaping the landscape of financial technology.

- AI-Driven Predictive Finance: Advanced AI models will automate complex financial decisions, from credit approvals to investment strategies.

- Real-Time Analytics and Decision-Making: The shift to real-time analytics enables instant risk assessment and dynamic pricing.

- Integration with Blockchain & Decentralized Finance (DeFi): Predictive analytics will play a key role in analyzing on-chain data, smart contracts, and decentralized financial ecosystems.

- Increased Focus on Explainable AI: Transparent and interpretable models will be prioritized to build trust with customers and regulators.